Homepage

Join us!

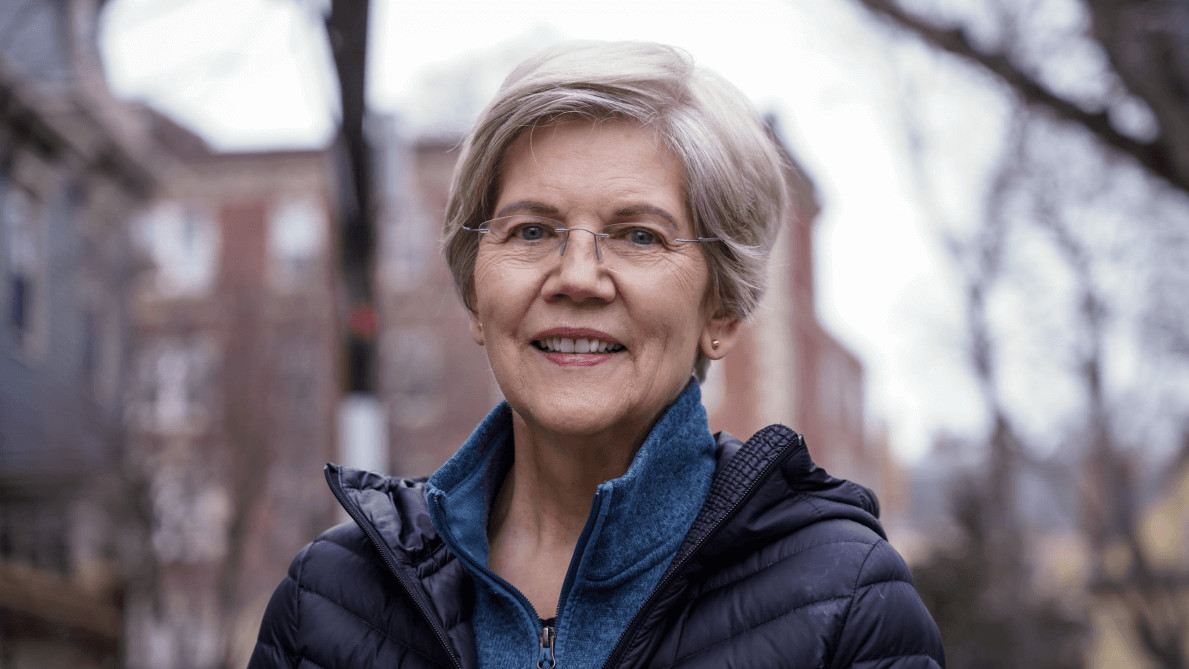

Get updates from Elizabeth and find out how to fight by her side.

Latest news

See all newsCNN: After bank failures, Elizabeth Warren demands Fed crackdown on large regional banks

March 22, 2023

Senator Elizabeth Warren is cranking up the pressure on the Federal Reserve following the collapse of Silicon Valley Bank.

Read MoreCBS News: Democratic senators call for crackdown on wealthy tax-dodgers

March 21, 2023

In a March 20 letter shared with CBS MoneyWatch, Senators Elizabeth Warren, Bernie Sanders, Chris Van Hollen and Sheldon Whitehouse are asking the Treasury to "limit this blatant abuse of our tax system by the ultra-wealthy."

Read MoreThe New York Times Opinion: Silicon Valley Bank Is Gone. We Know Who Is Responsible.

March 13, 2023

No one should be mistaken about what unfolded over the past few days in the U.S. banking system: These recent bank failures are the direct result of leaders in Washington weakening the financial rules.

Read More